Big news for small businesses: A December 3, 2024 court ruling in Texas has put a pause on the enforcement of the Corporate Transparency Act (CTA).

Learn moreIntriguing info bites for National Women’s Small Business Month

Read time: 5 minutes

Women are doing it all—including crushing it as business owners and leaders. So, in honor of National Women’s Small Business Month in October, we have some fascinating factoids about women in business.

There are nearly 13 million women-owned businesses in the United States (that’s 42% of all companies in the U.S.). They employ 10 million people and generate about $1.8 trillion annually. (American Express)

17% of Black women are starting businesses—faster than white women, at 10%, and white men, at 15%. (Harvard Business Review)

Female entrepreneurs in the U.S. rank their happiness at almost three times that of women who aren’t entrepreneurs or business owners. (Inc.)

In 2021, the number of women running Fortune 500 businesses hit an all-time record of 41. (Fortune)

As of 2021, 90% of companies worldwide have at least one woman in a senior management role. (Grant Thornton)

Companies with women in executive positions have a 34% higher total return to shareholders than companies that don’t. (Catalyst)

Adding one more woman to a company’s board of directors, while keeping the board size the same, produces a return on investment (ROI) of 8-13 basis points. (Egon Zehnder via Catalyst)

Female entrepreneurs ask for $35,000 less, on average, in business financing than do men—$89,000 on average for women vs. $124,500 on average for men. (Fundera)

Between 2014 and 2016, the number of employer firms owned by women grew 6%—twice the rate of employer firms owned by men. The growth was driven mostly by a 14% increase in employer businesses owned by minority women. (U.S. Small Business Administration)

In 2020, 28% of all business loan applications came from women-owned businesses. In 2021, 33% of all loan applications came from women-owned businesses. (2022 Biz2Credit Women-Owned Business Survey)

The average loan size for women-owned businesses in 2021 was $49,712, while the average loan size for men-owned businesses was $83,198. Loan approval rates were 40% for women and 41% for men. (2022 Biz2Credit Women-Owned Business Survey)

Women are globally paid less than men, earning on average only 77% of men’s wages. (UN Women)

48% of female founders say what holds them back is the lack of available mentors or advisors. (Inc.)

The World Economic Forum calculated that the pay disparity gap between men and women would not close until 2157. (World Economic Forum)

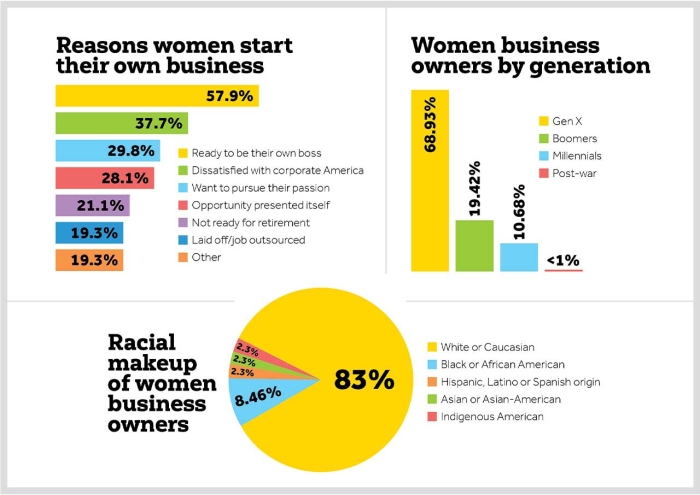

And here are a few interesting insights, all from Guidant Small Business Trends 2022: Women in Business.

Most women business owners work in the following industries:

Retail, including storefront and eCommerce (22.3%)

Health, beauty and fitness services (16.1%)

Business services (12.5%)

Food and restaurant (11.61%)

Education and training (5.36%)

Other (<5%)

The top challenges for women business owners:

Recruiting/retention (54.4%)

Lack of capital/cash flow (30.4%)

Changing operations in the face of COVID-19 (28.6%)

Marketing and advertising (22.6%)

The top plans for 2022 for women-owned businesses:

Increase staff (58.3%)

Invest in digital marketing (37.0%)

Expand or remodel business (31.5%)

Invest in traditional marketing (20.4%)

Invest in business services tech (10.2%)

Invest in information services tech (10.2%)

As you can see, women have come a long way—and they still have a long way to go. But with so many hard-working female entrepreneurs and leaders building strong businesses and networks, there’s no doubt we’ll have even more impressive statistics to celebrate during next year’s National Women’s Small Business Month!